tala loan interest|How much can I borrow? – Tala Philippines : Tagatay Get online personal loans at low rates. Download the Tala cash loan app and . SM Hotels and Conventions Corp. (SMHCC) announces the appointment of Michael Jaey C. Albaña as Vice President/General Manager of SMX Convention Center (SMXCC). . Alexis is currently the Food Hygienist handling all the properties under SMX Convention Center. She brings with her seven years of extensive experience in Food .

PH0 · What kinds of fees and interest does Tala charge? – Tala

PH1 · Tala: Fast Cash Peso Loan App

PH2 · Tala loan app Review: App

PH3 · Tala Loan Application: Borrow Cash with Just a Few Taps Away

PH4 · Tala Loan Application: Borrow Cash with Just a Few Taps Away

PH5 · Tala Cash Loan

PH6 · Tala App Philippines

PH7 · Tala

PH8 · Loan amounts & Fees

PH9 · How much can I borrow? – Tala Philippines

PH10 · (5M+ Installs) Download the Tala App

trustytime Trusted Dealer. Trusted Dealer. 3/4/16 1,965 1,619 113. 1/11/20 #1 GMF Factory is first to release the True Asian 3285 CHS Clone movement, and they have done a comparison against the gen parts. . Sent from my iPhone using RWI . A. arpa90 Active Member. 2/11/18 248 178 43. 1/11/20 #9

tala loan interest*******How much is the interest for Tala loans in the Philippines? The interest rates for Tala Philippines are as follows; • Monthly EIR: 15.00% • Maximum Annual Percentage Rate (APR): 182.5%

Gain access to a fast, flexible, and secure way to borrow up to PHP 25,000 with .Get online personal loans at low rates. Download the Tala cash loan app and .

Get online personal loans at low rates. Download the Tala cash loan app and get fast approvals in 5 minutes. Apply now!

tala loan interest How much can I borrow? – Tala PhilippinesGet online personal loans at low rates. Download the Tala cash loan app and get fast approvals in 5 minutes. Apply now!Gain access to a fast, flexible, and secure way to borrow up to PHP 25,000 with rates as low as PHP 5* a day (* for a PHP 1000 credit limit). Kumpletuhin ang application sa loob ng ilang .Peb 8, 2023 — Learn how to get a quick and flexible loan from Tala, an online lender in the Philippines. Find out the Tala interest rates, fees, requirements, and application process.👉 KEY TALA FEATURES. ULTIMATE CONTROL. • You choose your repayment date. • If your plans change, the cost of your line of credit will automatically adjust. NO HIDDEN FEES. • Service fees as low.Tala’s rates are fair and transparent. We do not have any hidden charges and the cost of your loan will always be made clear to you from the beginning. Check the Tala App for more details .Term: 21 or 30 days. Interest: 0.75% per day for 21 days and 0.5% per day for 30 days. Note that first borrowers always have the smallest amount possible. Tala says that the company wants to build mutual trust so repeat users can .Ago 13, 2024 — Tala Credit. Loan limits. How much can I borrow? Initial offers can range from ₱1,000 to 3,000 and can grow up to ₱25,000 if you regularly pay on time. All loan amounts are .

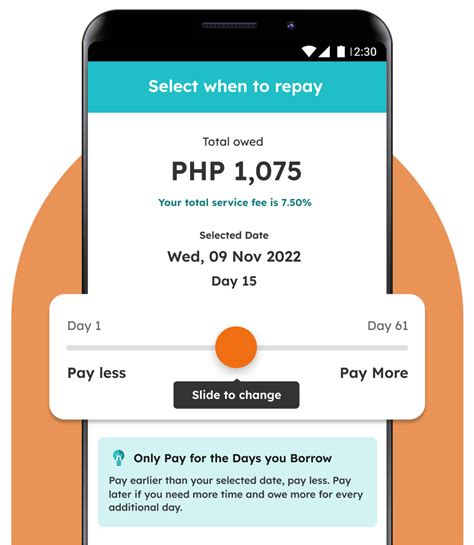

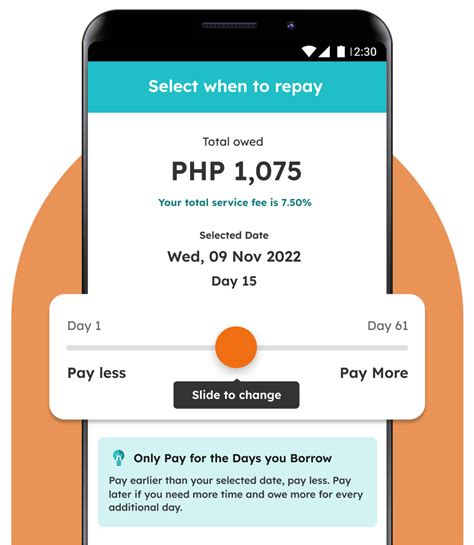

Enjoy fast, flexible, and secure loans up to PHP 25,000 with rates as low as PHP 5 per day. Loan amount from PHP 1000 to 25,000. Loan terms from 1 to 61 days. Interest Rate 0,5% per day. .Get a Tala Cash Loan to address your baby’s needs. Medical emergencies - Nothing spells immediate money as much as a medical emergency. With Tala Cash Loan, it’s easy to get .Dis 13, 2023 — Tala apk interest rates. As far as interest rates are concerned, the Tala Philippines interest rates are quite low. The company says that the annual rate does not exceed 208%.Tala charges a service fee of 9-42% of principal (EIR**: 10.5-17.1%; APR: 127.8-208.7%).• Earn ₱200 off the next time you borrow when you refer friends to Tala!* Unlike other traditional online loan or cash loan apps, Tala is not a loan app but an enhanced credit experience with continuous always-on credit available to .Tala loans charge a standard daily fee. You will only be charged for the days when you are using the loan service. Loan interest rates are from as low as 0.5% PH per day and you decide how long you need the loan for — the .

Pay your loan by the due date to maintain or even lower your interest rate fee and remain in good standing with Tala. To apply for a Tala loan, you must first download the app and apply from within the app. To download the app, please visit your country's official site: Tala Loan App Kenya. Tala Loan App Philippines. Tala Loan App Mexico. Tala .

Set 6, 2022 — Interest and Fees: Tala’s daily interest rate falls between 0.3% and 0.6%, subject to change (check the app or Play Store for latest rates). An excise tax of 20% applies on top of the daily interest. Remember: Borrow responsibly. Only apply for what you can comfortably repay within the loan term. The Tala app provides all the details about .Humiram ng Tala loan up to PHP 25,000 and enjoy transparent fees as low as PHP 5* per day. Walang surprises o hidden charges. * Applies to a PHP 1000 Tala Loan. . E-money does not earn interest and is not considered a deposit, hence it is not insured with the PDIC. UnionBank and EON are regulated by the Bangko Sentral ng Pilipinas (BSP) with .

Tala is regulated by the Securities and Exchange Commission, with email address at [email protected]. The Tala Wallet is an e-money instrument issued by the UnionBank of the Philippines. E-money does not earn interest and is not considered a deposit, hence it is not insured with the PDIC.

Nob 21, 2020 — Tala Philippines loan interest and term. The interest of the loan depends on your repayment term. If repay within 21 days the interest is 11.4% to 13.3% and tax; If repay within 30 days the interest is 15.2% to 17.1% and tax; Ex: if you get PHP 2,000 in 30 days, you have to repay PHP 2320 to PHP 2360. The payment include the service fee at PHP .See also: Personal Loan from GSIS . Tala Loan Interest Rate and Other Terms. As with other short-term basic personal loans, Tala’s offers feature only three important characteristics. Here they are: Amount: from P1,000 to P10,000. Term: 21 or 30 days. Interest: 0.75% per day for 21 days and 0.5% per day for 30 days.With Tala Cash Loan, it’s easy to get fast cash with an application process that only takes minutes through the app, followed by an instant decision. . Monthly effective interest rate: 14.74.% to 15%, depending on the loan term; a one-time charge. Late payment penalty fee: .

Tala Loan Interest Rates. Tala’s loan application features a variable interest rate ranging from 15% to 15.7% per month. Additional fees include a service fee of either 11% (for a 21-day loan term) or 15% (for a 30-day loan term), along with a late .How much can I borrow? – Tala PhilippinesAgo 19, 2024 — Tala loan interest rates. Tala loan application form online has a variable interest rate that runs from 15% to 15.7% per month. Other fees include a service fee that is either 11% (for a loan term of 21 days) or 15% (for a loan tenure of 30 days), as well as a late payment fee that is 8% of the total amount owed. .Through Tala’s money app, customers can bypass the barriers imposed by legacy institutions to access an instant, personalized credit line. The application takes minutes, and real-time underwriting means our customers get the right offer as they grow with Tala. . “When I got approved for a loan it was like a huge weight has been lifted off .Our online loan app offers competitive interest rates and a longer repayment tenure (90+ days). Tala values transparent and ethical lending practices and our fee structure has no hidden costs or surprises. In India, we partner with a trusted RBI registered and approved NBFC to offer our customers the highest levels of safety and confidence .Your Tala Limit is the maximum amount that you can cash out.. For example: If you have been approved for P2,000 on your first Tala application, your Tala limit is P2,000. You can choose to withdraw a partial amount or the full amount depending on your needs. Access to a credit line simply means that you have repeat access to cash from Tala. This allows you to continuously .

May 14, 2024 — 📌 Tala Loan. Loan amount: Up to ₱25,000; Interest rate: 0.43% to 0.5% (daily service fee) Loan term: One to 61 days; Application requirements: . You can even get a first loan at 0% interest for a seven-day term. Read more: Digido Loan Review: How Reliable is This Online Lending Platform? 📌 Esquire Financing Business Loan.For any questions or concerns, please visit gotala.co/help or interact through the official Tala app. Tala is operated by Tala Financing Philippines Inc., a licensed financing company with SEC Registration No. CS201710582 and Certificate of Authority No. 1132, and a registered operator of payment system, with OPS Registration No. OPSCOR-2023-0010.tala loan interestSet 18, 2023 — If you fail to pay off Tala Loan on time, you will be charged a late payment interest equal to 8% of the outstanding balance. This is in addition to the daily interest rate, which ranges from 0.3% to 0.6%, charged on the amount of credit borrowed.

Theoretical Ex-Rights Price or TERP is the price of the shares immediately after the rights issue. A rights issue is the offering of shares to existing shareholders.

tala loan interest|How much can I borrow? – Tala Philippines